Education

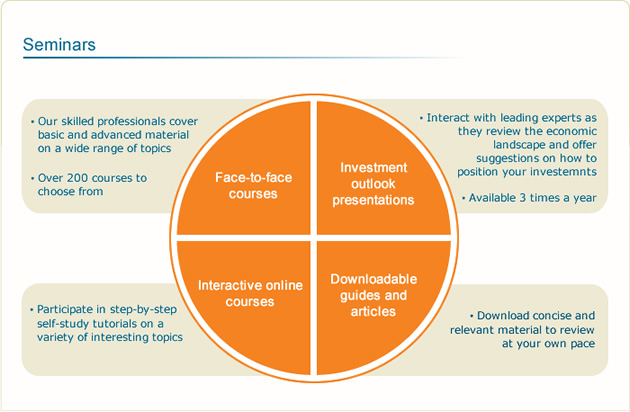

We have developed a broad repertoire of material over the past years. Our educational materials or courses are designed to suit all levels of investors and their interests. We recommend that you check back here from time to time to view course updates and new course topics.

Click on your preferred learning method below for more information on what is available.

Face-to-face courses

We run over 200 free courses a year to help you to invest or trade wisely on the JSE Limited. Click on a topic below for the dates and details of the course you are interested in or contact us for more information.

Introductory level courses

- Getting started in shares

- Introduction to investing

- JSE Limited Investment outlook

- JSE Limited investment showcases

Intermediate level courses

- An Introduction to fundamental investing

- Understanding company financials and announcements

- Trade to trade well

- Introduction to technical analysis

- Detailed Option course (warrants & Instalments)

Advanced level courses

- Introduction to Contracts For Differences

- Trading Index Futures

| Getting Started in Shares (Basic) |

|

||||||

| Introduction to Investing (Basic) |

| Description Any one from novice to seasoned investors who want to recap on the basics will benefit from attending this course. The course will cover the following topics:

The course will be very practical and will use examples from the website. Who can attend Cost / Duration |

| Investment Outlook of the JSE (Basic) |

Description Who can attend Cost / Duration |

| Introduction to Fundamental Investing (Intermediate) |

| Description If you have attended the “basics of investing", found your way around the website, and are getting more critical about your investment decisions, you will gain much value from this course. It is designed for people who want to start putting "fundamentals" to work, and shows how simple and easy it is for Standard’s online users to find and use fundamental data – for their own benefit. What are fundamentals? By looking at the economics of a business, the balance sheet, the income statement, management and cash flow, investors are looking at a company's fundamentals, which help determine a company's health as well as its growth prospects. Unlike its cousin technical analysis, which focuses only on the trading and price history of a stock, fundamental analysis focuses on creating a portrait of a company, identifying the intrinsic or fundamental value of its shares and buying or selling the stock based on that information. The course will help you to:

Content includes examples of Share Selection using fundamentals for your portfolio, illustrated with clear, actual examples from the JSE using tools and data available to you within the online trading website. The course is presented by Stuart Thompson, an independent asset manager. Who can attend Cost / Duration |

| Understanding company financials and announcements (Intermediate) |

Description Who can attend Cost / Duration |

| Trade to trade well (Intermediate) |

| Description What you trade is not important; be it derivatives, shares, indices, commodities or any combination – at the end of the day trading is all about one thing and one thing only – having a plan. So what’s your plan? How do you manage the emotions of trading? What gets you into a trade? Are you ruthless with stop losses? Do you have an exit plan for when you enter a trade? What about managing risk? How big is each trade? How many trades before you wipe out? Successful trading requires knowing what's important, understanding your position within the market and how that affects us. The two hour presentation will look at all the aspects of trading; from having an initial overall plan to system design and trade execution. We’ll cover market truths and how they impact the trader, dealing with trader bias as well as the two big killers – fear and greed. The course is designed to be challenging and will help all levels of traders move to the next level. Who can attend Cost / Duration |

| Introduction to technical analysis (Intermediate) |

| Description Technical analysis is the study of market price movements, primarily through the use of charts, for the purpose of forecasting future price trends. This can be useful in deciding when to buy or sell shares for both investors and traders. This course is being run by Riette Kotze and will cover the following topics:

This a full day course (8.30am to 4.30pm) and includes lunch. Who can attend Cost / Duration |

| Detailed option course (warrants & instalments -Intermediate) |

| Description Traded on the JSE Securities Exchange options (share instalments and warrants) are an exciting and innovative investment tool for the South African investor. One of the key benefits of an option is leverage. Put simply, leverage allows you to get exposure to a large parcel of underlying shares for a relatively small capital outlay. Another benefit is that an option gives investors the potential to maximize financial returns while strictly limiting potential losses and allow investors with either a bullish or bearish view to trade profitably through the issue of both call and put warrants. Topics covered in detail include:

Who can attend Cost / Duration |

| Introduction to Contracts For Difference (Advanced) |

| Description A CFD is an unlisted instrument that is an agreement between a buyer and a seller to exchange the difference in value of a particular instrument on a daily basis for the period between when the contract is opened and when it is closed. The difference is determined by reference to an underlying instrument for the period that the CFD is held. CFDs are leveraged instruments. This means that you are fully exposed to price movements of the underlying instrument, similar to Single Stock Futures, without having to pay the full price of that instrument. The course will cover the following topics:

Who can attend Cost / Duration |

| Trading Index Futures (Advanced) |

| Description ALSI futures are considered by successful South African traders to be the holy grail of trading due to its liquidity, low cost structure, generally tight spread and overall great opportunity for trading. With that in mind Standard Online Share Trading has introduced this new course to familiarise clients with these products and to offer three potential trading strategies. The course will ensure a full understanding of the three available futures indices on Standard Online Share Trading (ALSI, ALMI and DTop) including the no-nonsense aspects of trading them, risks, costs, benefits and the tools used for trading them. Also included will be three practical and hands on trading systems for trading the ALSI (two intra-day systems and one overnight system). All three systems will be demonstrated using the Easy Trader charting platform. The presenter will be Simon Pateman Brown. PLEASE NOTE This course is aimed at advanced traders - at a minimum one should have attended the Trade to Trade Well course, have a good grasp of the concepts of trading and already be a profitable trader looking to take your trading to the next level. Further while the concept of trading is simple enough those attending need to fully understand that trading is all about psychology. WEALTH WARNING - Futures index trading carries a wealth risk warning – one can loose more than one invests. Who can attend Cost / Duration |

Interactive online tutorials

Our online tutorials are interactive and easy to download. Each module will walk you through key information on the selected product, allowing you to learn at your own pace. Read more details on your preferred tutorial below and click to download.

- Single stock futures

Understand the basics of singe stock futures and how to trade them.

- Warrants

Understand the basics of warrants and complete a quiz at the end of module to ensure that you have understood the key concepts.

- Share instalments

Understand the basics of share instalments and complete a quiz at the end of the module to ensure that you have understood the key concepts.

- Technical analysis (only available to Standard Online Share Trading clients)

This tutorial will help you to understand and apply technical analysis in the selection of stocks and the timing of your entry or exit from the market.

Downloadable guides and articles

Our insightful reading material covers several products and other important topics related to online share trading for your interest and enjoyment.

Click here for the full list of PDF guides and articles.

![]() International: +27 11 415 5000

International: +27 11 415 5000

Monday - Friday 8:30 - 17:30